When Monopoly goes beyond a game…

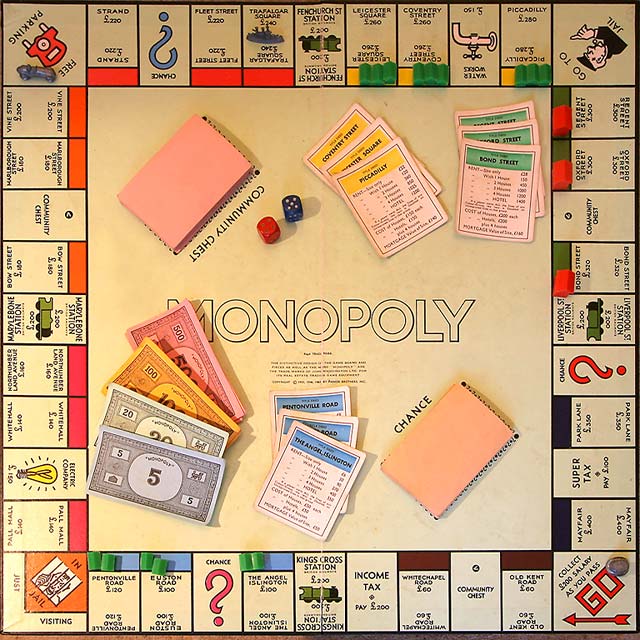

Back when we were kids, there was one well-worn answer to those long damp dreary days of the English so-called summer: pull out the board-games! One of which, of course, was Monopoly:

Which worked well, for a while. As kids, it was at about the right level of challenge for us: there was some element of strategy to it, even though in reality most of the game was just plain luck, or lack of it – a literal roll of the dice. The main problem – which perhaps too often led to fits of childish fury – was that, as an article in Wired once put it:

It’s all about cackling when your opponent lands on your space and you get to take all their money.

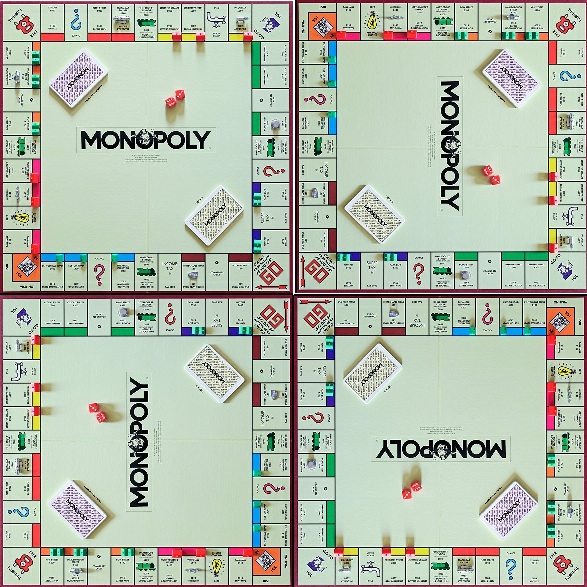

The less-visible problem was that the game didn’t last long enough – not if you’re trying to pass the time of too many soggy ‘summer’ days. And yes, we had a solution for that, too. We didn’t just have the one Monopoly set: we had four, of them, all different, all acquired or inherited somehow, and dating variously from the 1930s to the 1960s. Fun!

In a flash of inspiration somewhen, we realised that we could put all four boards together with the ‘Go’ squares in the middle, giving a clover-leaf path and pattern to the overall game:

It was a much bigger game, with a much bigger bank – and bigger is always better, right? The only limit was that the highest-denomination note was still only £500. Oh well.

But we had a fix for that too, because we also had the board-game Careers (a much better game than Monopoly, to be honest) – and the bank-notes in that game went all the way up to £10,000! Yes! If we pull those notes over to our quadruple-Monopoly, but keep the property-prices the same as before, then we’ll have a game that will last for days!

That was the idea, anyway.

It didn’t quite work out that way in practice…

It did all seem to work really well at the start of the game. The extra money made a big difference: everyone just bought up wherever they landed, because the prices were all relatively low compared to the amount of money that we’d each assigned ourselves. Everyone felt rich! big property-owners! wow!

And ‘Go To Jail’ was no problem, too: there was so much money sloshing around that the £50 penalty felt like no problem at all – just pay it and go, straight away, every time. Same with those standard taxes and other fees: so small, relatively speaking, that we could all but ignore them.

Then came the kind of fun-bit of horse-trading: I’ve got three of the Orange group, but they’re on different boards, can I swap you this other Orange for the one you’ve got, so we can both make a set?

After the horse-trading, it was time for house-building on our property-blocks – which happened fast, one, two, three, hotel, because, again, there was plenty of money still sloshing around.

At which point it started to get expensive to land on anyone else’s property, and have to pay the now hugely-inflated rent…

Which is where, all of a sudden, a random throw of the dice could make a big difference… ‘Go To Jail’ actually became the cheaper option, giving that player time to not land on someone else’s property, whilst the profits still kept rolling in when others landed on their own.

It didn’t take long before the aforementioned “cackling when your opponent lands on your space” started to arise, followed all too often by the also-aforementioned temper-tantrums. Oops…

Once the players started to need to mortgage their properties to pay off the exorbitant rents, the slide happened quite fast: in almost no time at all – sometimes on a single throw of the dice – a player would be thrown right out of the game, then another, then another. Each game eventually settled down to a multi-day slog between just two players – of whom one them was invariably also the player in charge of the game’s bank – each trying to wear the other down, and relying on nothing than random luck to do the job. In the meantime, the players who’d already dropped out had nothing else to do, and wandered off to play at something else – if only to get away from the aforementioned cackles.

In the end, we finally realised that all that that extra money had done was to make the game worse. The standard version was kinda boring; but after that first flush of heady excitement at the delusion of wealth all round, this extended version soon became no fun at all – in fact very much the opposite of fun for all but those last two players, whose illusion of wealth lasted longest, but had more of an aftermath to cope with from everyone else after the game reached its final implosion.

Which brings us back to the present, and to the real-world of the present-day…

That 1930s version of the game of Monopoly – the one that most people know – was, in effect, a near-perfect model of capitalism at its most-dysfunctional: an often spite-laden winner-steals-all zero-sum game, within which a single chance event can make all the difference between delusory ‘wealth’ and utter destitution, and often with no way at all to recover from the latter. Yet it was at least anchored in something resembling real-world monetary-values; and its embedded social-inequality within the game itself – with purchase-prices ranging from £60 (the supposed slums of Old Kent Road) to £400 (wildly-upmarket Mayfair) – was relatively small even by comparison with the real-world of the time.

But the extended-game that we’d built was different in several important ways, each of which ultimately exaggerated the worst features of the original game – and each of which also mirrored a real-world change that happened in the real-world economy and capitalist-culture somewhen over the succeeding decades:

- the bank was allowed to issue much more money, and much larger ‘free credit’ – exactly as with banking-deregulation in the 1980s

- the larger banknotes gave the illusion that money was limitless, creating a kind of tulipmania-style bidding-war during the horse-trading period of the game – exactly like the impact of deregulation of debt-limits and debt-controls, and the spiralling property-prices back in the real-world of the 1990s

- the extra money and the extra scope made it seem much more enticing for every player at the start, but soon much harder who’d missed out in any way in the early stages of the game – exactly like how inflated house-prices in the real-world made the ‘housing-ladder’ suddenly very much steeper to climb

- the money available was much greater, but fixed-penalties remained the same, greatly reducing the limiting-effect of any penalties, and allowing the game to spiral further and further beyond any reasonable limits – exactly as per the ‘too big to fail / too big to jail‘ status of banks and other finance-providers in the 2000s and beyond

- the player in charge of the bank was almost invariably the only winner, even though no-one else could quite see how or why – a point with notable echoes in the real-world of present-day?

- the disparity between ‘winners’ and ‘losers’ became enormously increased, yet that disparity was often blamed solely on the ‘losers’ themselves, rather than the impact of roll-the-dice fortune – exactly as per much of the politics of the present-day

- those huge disparities gave the ‘winners’ the delusion that that they were somehow inherently better than the ‘losers’, with much more money to flaunt, and more opportunities to indulge in ‘cackling’ at others’ misfortune – much as we see all too often these days from the supposed ‘winners’ of the real-world money-game

- the same disparities and overall ‘unfairness’ of the game created a strong desire amongst some players to not want ever to play the game again, or even a desire to destroy the game itself – much as is also happening in present-day politics, especially amongst the so-called ‘losers’ of that society…

Interesting analogy, anyway.

Or worrying, perhaps.

Hmm…

Leave a Reply