On ‘stupid’ organisations

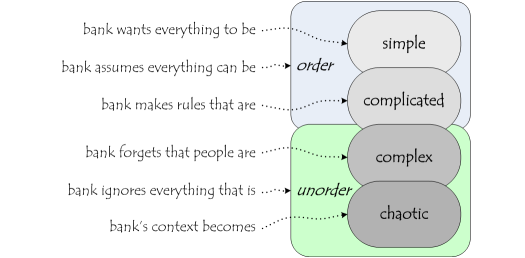

To link up with a discussion on ‘Possible examples of stupidity (or brilliance)‘, on the LnkedIn ‘Organizational Intelligence’ group, Richard Veryard and Geoff Elliott asked me to post this diagram, from my book Everyday Enterprise Architecture:

I believe Richard and Geoff want to use this diagram to comment on the current JP Morgan bank-losses case, but I’d have to leave the details of that to them. (Consider the diagram to be Creative Commons CC-BY-SA, please?)

The original context was a bank in central America that managed to drop from the most-respected in the region to the least-respected in just six months, at which point they realised they had a big problem on their hands; this diagram gives a succinct summary of what went wrong, and why.

Hope you find it useful?

(Note: when I wrote the book I was still trying to make A Certain It-May-Not-Be-Named Framework usable for enterprise-enterprise architecture, and hence the diagram still uses the terminology from that framework. These days I would use the SCAN framework instead – but I’d have to admit that that terminology above does have a certain terse symmetry about it. 🙂 )

Let me start by mapping the diagram onto the Org Intelligence framework.

“Bank assumes” – this is an act of sensemaking

“Bank makes rules” – this is an act of decision and policy

“Bank forgets” – this seems to be a question of corporate knowledge and memory. (Does the word “forgets” imply that this knowledge once existed but has now been lost? Or does it simply mean that this is something the bank ought to know and remember?)

“Bank ignores” – this is a question of information gathering and perception.

I don’t know if there was any particular sequence of error in the Central American bank case, or whether these errors were more or less simultaneous. I can’t see any obvious sequence in the JP Morgan case, but I don’t think that matters.

Hi Richard

“‘Bank assumes’ – this is an act of sensemaking” – I’d suggest this is more an act of not-sensemaking, or avoiding-sensemaking. In OODA terms, it’s like skipping over the ‘Observe’ phase and jumping straight to the ‘Orient’ phase, using assumptions instead of real-world observation as the basis for the sensemaking-assessment.

“‘Bank makes rules’ – this is an act of decision or policy” – yep, agree there. Note, though, that the rules were based on fairly arbitrary assumptions and self-centric wishful-thinking, so there wasn’t much connection with the real-world context there.

“‘Bank forgets’ – … corporate knowledge and memory” – yes, the knowledge did indeed exist in the past, but had been intentionally ‘forgotten’ (i.e. reality overruled) in the sense that it was assigned a very low priority relative to the belief that arbitrary self-centric policies would be more profitable. (Which they were – for a few months… 🙂 )

“‘Bank ignores’ – … information gathering and perception” – in reality, a systematic process of not gathering information and not perceiving what was going on until it was almost too late.

“I don’t know if there was any particular sequence of error” – there was some parallelism, of course, but otherwise it was pretty much a sequence as per that diagram. The real cause was abandonment of any concept of functional context-specific strategy in favour of arbitrary edicts from global headquarters (“our strategy is ‘last year + 10%'”). The local cause was a major push to get credit-cards out into general use, ignoring certain rather important issues such as the need for credit-checks, and ‘forgetting’ to explain to relatively financially-illiterate people key concepts such as that a credit-card is not ‘free money’, but needs to be paid back, at fairly high interest-rates. The resultant huge interest-fees were highly profitable for a short while, but (as you might expect) caused a huge social uproar, large enough to force the government to take action – placing that bank, and all the other retail-banks, in an interestingly difficult position. :wry-grin:

Sounds like the bank did have some kind of orientation, some way of understanding what-is-going-on, even if it wasn’t very good or appropriate to the situation, so I’d still want to call it sensemaking. Unless you are dead, you can’t avoid some level of perception, sensemaking, decisionmaking, memory, learning and communication. (Even if you try not to communicate, for example as a politician trying to avoid answering a question, you are still communicating something.)

I look at Tom’s schema as representing a kind of anti-pattern – a common but flawed way of combining perception, sensemaking, decisionmaking, memory, learning and communication – helping to explain a particular kind of stupidity that we may recognize popping up all over the place. It may also give us some clues about how we might go about remedying this kind of stupidity.

(May I take this opportunity to invite readers of Tom’s blog to join the Org Intelligence group on Linked-In. http://www.linkedin.com/groups?home=&gid=4422683)