Hidden perils of co-branding

For any organisation that’s in the public-eye, a co-branding deal sounds like a perfect win-win: you get a pile of useful cash merely for letting someone put up a load of posters around the place. What could possibly go wrong with that?

Uh… a lot, actually…

The key point in this is that there are many forms of value in play in these contexts – of which money is only one side of the story. If we ever forget that point, we’re likely to sleepwalk our organisations into serious trouble – without being able to understand what’s happened, or why.

This type of risk was illustrated well in a recent email from Stuart Boardman. He commented that “I was reading the umpteenth article about HSBC’s current scandal and there, unsurprisingly, was a large picture of their logo”, and then continued:

That made me think of all the entry/exit ramps at Heathrow terminals, which are so prominently decorated with the HSBC logo and associated slogans. Might that affect people’s attitude to Heathrow? To what extent is reputation transferrable?

Which is a really good point. For example, almost the first thing that anyone would see from the aircraft-window when arriving at Heathrow would be this:

Or, in the ramp, a barrage of panels like this:

And they’d see that long before they saw any branding for Heathrow itself. In fact HSBC’s advertising and branding is so pervasive in the entry/exit areas that it almost is the branding for the airport – so much so that it’s kinda ‘HSBC Heathrow Airport’, in the same sense that in sports we might see something like the (imaginary!) ‘SausageWorld Ski-Slalom SuperLeague’.

Such co-branding deals can be very lucrative, both for the host-organisation and the sponsor – but as Stuart notes above, there can be a nasty sting in the tail if anything goes wrong on either side, because both parties to the deal have will locked their reputation, and more, to each other.

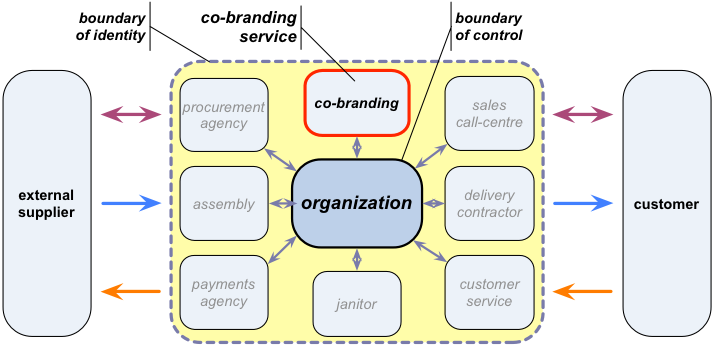

In effect, co-branding is an outsource-type relationship: yet what’s being outsourced in this case is part of each organisation’s identity, and in turn, part of their apparent enterprise-purpose, to the other. The result is that co-branding represents a reputation-type outsource-service that exists within the organisation’s boundary-of-identity, but outside of its boundary-of-control – with all of the hidden risks that that entails:

It’s important not to get too hung up on any of the specifics here: this is not actually about HSBC as such. For all its many real sins, HSBC is merely one player in what is all-too-evidently a full industry-wide game of ‘Pass The Grenade‘ – a kind of game that’s happening not just in banking but in all too many business-domains right now…

The core of any such game is a kurtosis-risk – a context that brings large rewards in the short-term, but conceals a hidden risk that will wipe out all of the gains, and more, at some unknown point in the future. ‘Pass The Grenade’ is a kind of multi-player version of this, in which, typically, just one player or a small handful of players will suffer all of the losses from all of the players when the kurtosis-risk eventuates – often leaving the other players to believe that it’s safe for them to continue the game.

The problem here is that, at a social level, it’s not exactly a wise game for one of society’s most central institutions to be involved in, as Mark Taibbi illustrates in his Rolling Stone article ‘Gangster Banksters‘:

[HSBC] helped to wash hundreds of millions of dollars for drug mobs, including Mexico’s Sinaloa drug cartel, suspected in tens of thousands of murders just in the past 10 years … also moved money for organizations linked to Al Qaeda and Hezbollah, and for Russian gangsters; helped countries like Iran, the Sudan and North Korea evade sanctions; and, in between helping murderers and terrorists and rogue states, aided countless common tax cheats in hiding their cash.

One of Taibbi’s government-level interviewees put it somewhat more forcefully:

They violated every goddamn law in the book. They took every imaginable form of illegal and illicit business.

And yet the outcome for the bank and its executives was utterly disproportionate, from a social perspective:

That nobody from the bank went to jail or paid a dollar in individual fines is nothing new in this era of financial crisis. What is different about this settlement is that the Justice Department, for the first time, admitted why it decided to go soft on this particular kind of criminal. It was worried that anything more than a wrist slap for HSBC might undermine the world economy. …

It was the dawn of a new era. In the years just after 9/11, even being breathed on by a suspected terrorist could land you in extralegal detention for the rest of your life. But now, when you’re Too Big to Jail, you can cop to laundering terrorist cash and violating the Trading With the Enemy Act, and not only will you not be prosecuted for it, but the government will go out of its way to make sure you won’t lose your license. Some on the [US Capitol] Hill put it to me this way: OK, fine, no jail time, but they can’t even pull their charter? Are you kidding?

(To ‘pull their charter’ in this case would be revocation of the bank’s formal license to trade, in effect, putting the bank itself in metaphoric ‘jail’ – see ‘Should companies go to jail?‘.)

The danger right now is that, for those banks, the risks still seem low enough to make it worthwhile continuing the game: the profits are huge, and even the financial penalties so far have been almost trivial – rarely more than a few weeks’ profit at most. Up until now, each ‘grenade’ has, for them personally, seemed more like a damp squib than anything serious. Yet each new incident creates yet more anticlients – and it’s now getting steadily closer to the point where a critical mass of people would be more willing to put the entire global money-system at risk than to allow the game to continue any more. For example, to quote Margaret Hodge, the MP currently chairing the British Parliament’s Public Accounts Committee:

would you let a bankrobber go free in exchange for returning the money they had stolen?

When even the mainstream politicians are getting upset about this – and apparently not solely for show – then yes, there’s a lot of anger building up here…

Which, for any organisation engaged in co-branding with those banks (as in this case), represents a rapidly-increasing risk of being tarred with the same brush – no matter how blameless they themselves might be. Stuart Boardman expressed similar concerns about this in his email:

And then by extension the effect of all the new HSBC anti-customers on the bank itself but also on its project partners. And how much damage can that do to HSBC CSR (Corporate Social Responsibility) projects?

Short-answer: a lot of damage. Full scale out-of-business-forever kind of damage, in some cases – yet for something that they themselves have not done.

Yeah, that kind of damage. Ouch…

So whilst the opportunities in co-branding may seem great, the concomitant risks are also very real – and, if we fail to pay sufficient attention, could well include one or more full-blown kurtosis-risks. Not A Good Idea to ignore, perhaps?

Implications for enterprise-architecture

For enterprise-architects, probably the most common – and dangerous – mistake here is to allow ourselves or others to dismiss these issues as ‘just politics’, ‘not relevant to business’.

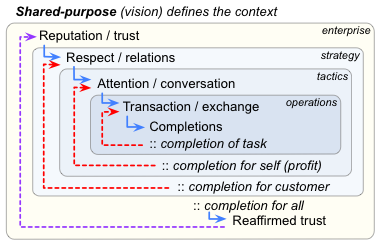

The mistake most often arises from taking a too-narrow transaction-oriented view of interactions with an organisation’s stakeholders. Classic ‘push-marketing’, for example, focusses almost exclusively on finding every possible way to grab people’s attention, and then divert them towards transactions that would be profitable for the organisation:

Yet in reality, that attention/transaction loop is only a small and often-misleading subset of the actual service-cycle, that needs to focus more on creating and maintaining reputation and trust, that in turn will support forms of ‘pull-marketing‘ that are far more effective all round over the longer term:

Architecturally-speaking, this outer part of the service-cycle is not something we can ignore: if reputation, trust or respect are lost, the entire business can grind to a halt – sometimes even overnight, as all too many e-commerce companies have discovered to their cost. Even in an effective-monopoly, where the client-relationship is more like ‘citizen’ than ‘customer’, loss of trust and suchlike can cause greatly-increased friction and reduced efficiency all round – with concomitant loss of profits, or even loss of the effective-monopoly itself. Again, it’s Not A Good Idea to ignore this…

At the very least, assessment of reputational kurtosis-risks is an essential part of due-diligence for co-branding – or for any other form of outsourcing, for that matter.

The chief source of difficulty for enterprise-architects in this seems to be that wretched delusion that anything that does not centre solely around money is somehow ‘irrelevant to business’. For example, in my own case, I’ve at times been branded ‘a hippie’, ‘a left-wing nuisance’, somehow supposedly ‘anti-business’ and worse – solely for having pointed out that other factors than money alone are fundamental to the context, as in those diagrams above. Reality is that that delusion is one that we have to face, however hard it may be – and hence some of the following posts here may be useful in that task:

- ‘Values-architecture 101‘

- ‘More on values-architecture‘

- ‘Back on the values-trail‘

- ‘Why ‘Economics 101’ is bad for enterprise-architecture‘

- ‘Why the bottom-line doesn’t come first in enterprise-architecture‘

- ‘Boundary of identity, boundary of control‘

- ‘More on boundary-of-identity versus boundary-of-control‘

- ‘Four principles for a sane society – an addendum‘

In this context, the real business-risk is in the development of anticlient-relationships that arise not from our own organisation’s actions or inactions, but from those of a co-branding partner. And as I warned in a previous post:

[Anticlients matter], because ultimately everyone in the extended-enterprise is a ‘customer’ of the organisation, whether they buy anything or not. The market dependencies can be summarised as reputation -> trust -> respect -> attention -> transaction -> money. So unless we do model all of this, we would have no means to understand where our monetary profit is actually coming from – or where it could vanish without apparent warning.

If you want to explain that you’ve built an architecture that has no means to detect how the company’s market could vanish overnight, be my guest. 🙂

Hence, more practically:

If you want to build something that can identify what’s going on both inside and outside the organisation, model values as values, and enterprise as enterprise, much as described above.

You Have Been Warned, perhaps? 🙂

Thanks Tom. This is exactly what I’d hoped for and I shall give it as much air as I can. It’s also a great, real world example to help people understand your ideas.

Many thanks, Stuart – and thanks again for suggesting the topic, of course, and providing the core material with which I was able to work. 🙂

Hi Tom — I’d love to see a treatment of branding in general. I started such a thing here http://enterprisology.com/node/164 , and keep promising myself I’ll get back to fleshing out the “enterprisography” section of this site. Maybe if I can get someone to buy my brand in a lucrative co-branding deal 🙂

Hi Tom,

Thank you for the post. It is always nice to hear a discerning voice on a topic I specialize in, just to keep my wits’ about myself. I do agree to an extent, when a brand becomes overly tainted it does lose value. However their are many mitigating factors internally and externally to consider. Such as Coca-Cola and McDonald’s. For them co-branding catapulted nicely. In fact Coca-Cola has also done this with Six Flags theme parks and others as well.

As a holding company for co-branding on coffee cups. We use co-branding as a means for coffee distributors to re-sell green coffee cups to brand name coffee environments at prices cheaper than regular disposable coffee cups that in-turn double their profits.

This also provides a sustainable economic and environmental solution to convenience stores and other food service vendors as well. Who are then able to afford to put their best face forward in the public eye. The discount for them increases top line revenues allowing them both to hire employees, rather than face lay-offs’, scale growth and profitability which ultimately is reflected in the bottom line for both entities. Which adds value to their brand. It all boils down to control of greed. All parties can benefit from the process. However as with all things in life… Moderation is the key to health.

You can learn more about this solution and my thirteen years of due diligence on this subject matter at: https://www.linkedin.com/pulse/what-coffee-cup-advertising-ronald-simons?trk=pulse_spock-articles

Cheers,

Ronald Simons